St George Thrives Insider

Archives

Utah's New Wildfire Risk Maps Ignite Homeowner Insurance Concerns

SIGN UP FOR OUR NEWSLETTER

Utah's New Wildfire Risk Maps Ignite Homeowner Insurance Concerns |

Residents in High-Risk Zones Face Rising Premiums and Coverage Challenges |

Utah homeowners are confronting escalating insurance premiums and potential coverage cancellations following the state's release of updated wildfire risk maps.

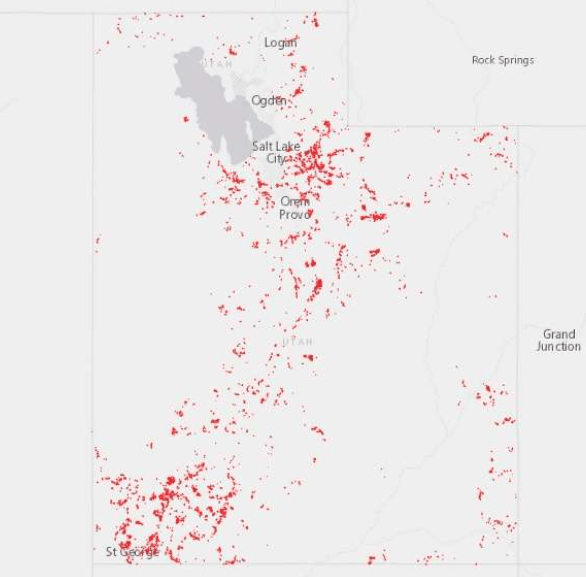

The Utah Division of Forestry, Fire & State Lands recently unveiled the High-Risk Wildland Urban Interface map, identifying nearly 60,000 structures statewide as being at elevated risk for wildfires.

In Dammeron Valley, residents like Steve Friend are grappling with the implications of their properties being classified within these high-risk zones.

Friend contends that the mapping system broadly categorizes areas without accounting for individual fire mitigation efforts or specific property conditions.

He notes that his own property received a risk score of 5, yet it falls within the designated high-risk area.

"They're just drawing a picture, swatting an area and saying these are going to be high-risk areas," Friend remarked.

The updated maps are a result of House Bill 48, enacted in 2025, which mandates the identification of high-risk areas and requires insurance companies to utilize state-provided maps for risk assessment.

According to Jamie Barnes, director of the Division of Forestry, Fire & State Lands, the legislation aims to standardize risk evaluation and address rising insurance costs.

"The idea behind this bill is to really put standardization to the map and to create a map within the state of Utah that insurance companies use when analyzing coverage," Barnes explained.

Homeowners across Washington County have expressed frustration with the broad assessments.

Laura Miller of Santa Clara, who has implemented fire prevention measures such as removing landscaping within five feet of her home, believes her property should be evaluated on its individual merits.

Similarly, Jarice Butterfield of Dammeron Valley voiced concerns about the financial impact of the new designations on homeowners' insurance.

The insurance implications extend beyond properties within the designated high-risk zones.

Tom Mertz, a resident of Desert Canyons, noted that his insurance rates increased despite his home being located two blocks outside the high-risk area.

"They said the insurance company is using a tool that identifies open spaces. And if it's an open space, they assume that there was a fire danger," Mertz said.

In response to these challenges, the Dammeron Valley Fire Special Service District has formed an Insurability Committee to assess local exposure and develop strategies to maintain property insurability.

The state maintains that the mapping system aims to create consistency in wildfire risk assessment while providing property owners with opportunities to appeal their designations through the established process.

As Utah continues to address the complexities of wildfire risk and insurance coverage, homeowners are encouraged to stay informed and proactive in mitigating potential hazards. |